Mauritius has positioned itself as one of Africa’s most business-friendly jurisdictions, offering political stability, strong financial services infrastructure, and a regulatory environment aligned with global standards. As multinational organisations expand into Africa and the Indian Ocean region, Mauritius often becomes a strategic base for HR operations, project deployment, and regional workforce management. However, despite its efficiency, employers must still navigate detailed labour regulations, payroll obligations, immigration rules, and HR governance requirements. Leveraging PEO Mauritius solutions provides companies with a compliant, low-risk, and operationally efficient employment model for establishing or scaling their workforce in the country.

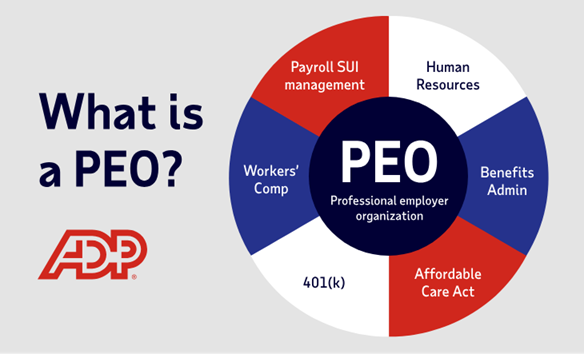

Understanding the PEO Model in Mauritius

A Professional Employer Organisation (PEO) serves as the legal employer for workers on behalf of a client company. While the organisation directs daily tasks, the PEO manages statutory, administrative, and HR obligations. This structure enables companies to hire talent in Mauritius without setting up a local entity such as a domestic company or global business corporation.

Key Functions of a PEO

A PEO delivers a comprehensive suite of employment services, including:

- Drafting and issuing compliant employment contracts

- Managing monthly payroll, tax deductions, and statutory filings

- Administering social security (NPS) and corporate tax-related submissions

- Maintaining employee files, HR documentation, and employment records

- Coordinating occupational health requirements and workplace compliance

- Supporting visa and work permit applications for expatriates

- Managing onboarding, leave tracking, and day-to-day HR administration

This operational model ensures that organisations maintain complete compliance with Mauritian employment legislation while benefiting from faster hiring cycles and streamlined HR management.

Employment and Labour Regulations in Mauritius

Mauritius has a structured, transparent labour system that regulates employment conditions, compensation, leave, workplace safety, and termination procedures. Compliance with these statutory obligations is mandatory for all employers.

Core Labour Compliance Requirements

Key areas that employers must manage include:

- Written employment contracts specifying job duties, remuneration, and working conditions

- The Workers’ Rights Act, which governs working hours, rest periods, overtime, and employee protections

- Annual leave, sick leave, and public holiday entitlements

- Maternity leave, adoption leave, and other family-related provisions

- End-of-year bonus requirements, including the mandatory 13th-month payment

- NPS (National Pension Scheme) and NSF (National Savings Fund) contributions

- Income tax deduction at source (PAYE) and monthly filings

- Termination procedures, including notice periods and severance calculations

- Occupational health and safety obligations for relevant sectors

Because these rules apply across industries and employment categories, organisations often rely on PEO solutions to ensure ongoing compliance and accurate interpretation of local regulations.

Employment Contracts and Legal Framework

Employment contracts in Mauritius must comply with the Workers’ Rights Act and contain clear clauses related to working conditions, compensation, and employee entitlements. A structured contract protects both the employer and employee while ensuring alignment with statutory requirements.

How a PEO Ensures Contract Compliance

A PEO manages contract development by:

- Preparing legally compliant fixed-term or indefinite contracts

- Including role descriptions, performance expectations, and wage structures

- Clarifying benefits, bonuses, allowances, leave entitlements, and probation rules

- Defining termination procedures in accordance with national legislation

- Managing contract renewals, amendments, and record-keeping

- Ensuring documentation is audit-ready and aligned with government requirements

This process supports transparency, legal compliance, and operational consistency across all employment relationships.

Payroll Administration and Statutory Deductions

Payroll in Mauritius is governed by detailed legislation that requires accurate calculation of income tax deductions, social security contributions, allowances, benefits, and end-of-year payments.

Payroll Functions Managed by a PEO

A PEO administers payroll with full compliance by:

- Computing monthly salaries and employer contributions

- Applying PAYE tax deductions based on Mauritius Revenue Authority (MRA) guidelines

- Managing NPS, NSF, and levy contributions

- Processing overtime, allowances, and industry-specific payments

- Managing mandatory end-of-year bonus calculations

- Submitting monthly and annual payroll declarations

- Issuing payslips and maintaining payroll records

This ensures accuracy, timeliness, and compliance while reducing internal administrative burdens.

Social Security and Statutory Contributions

Mauritius requires employers and employees to contribute to retirement, savings, and welfare programs. These contributions must be calculated and submitted accurately to avoid penalties.

How a PEO Supports Social Security Compliance

A PEO ensures:

- Registration of employees for statutory schemes

- Monthly NPS, NSF, and levy contributions

- Accurate calculation of employer and employee shares

- Timely submission of declarations to relevant authorities

- Record-keeping for compliance audits

- Deregistration at the end of employment contracts

This structured approach ensures alignment with national pension and savings regulations.

HR Governance and Workforce Administration

Effective HR governance is essential to maintaining compliant and productive workforce operations in Mauritius. This includes documentation management, policy alignment, employee relations, and regulatory monitoring.

HR Services Delivered by a PEO

A PEO manages various HR administrative functions, including:

- Onboarding and employee documentation management

- Leave administration and attendance tracking

- HR policy development and compliance monitoring

- Coordination of performance documentation

- Handling disciplinary and grievance procedures

- Ensuring adherence to workplace compliance standards

These services provide organisations with a governance framework that strengthens operational efficiency and reduces HR-related risks.

Expatriate Management and Work Permit Compliance

Mauritius attracts international talent across sectors such as financial services, ICT, hospitality, renewable energy, and global operations. Hiring expatriates requires compliance with visa and work permit regulations overseen by the Economic Development Board and Immigration Office.

PEO Support for Expatriate Employment

A PEO manages expatriate compliance through:

- Preparation and filing of work permit and occupation permit applications

- Coordination of visa issuance, renewals, and residency documentation

- Monitoring eligibility criteria, including salary thresholds and professional qualifications

- Supporting relocation and onboarding processes

- Maintaining regulatory records for inspections or audits

This ensures that expatriate staff can work legally and efficiently without administrative delays.

Termination and Offboarding Procedures

Termination in Mauritius must be conducted in line with the Workers’ Rights Act, which outlines procedures, notice requirements, and severance rules. Non-compliance may lead to disputes or financial penalties.

How a PEO Manages Termination Compliance

A PEO facilitates compliant offboarding by:

- Reviewing legal grounds for termination

- Preparing termination letters and statutory documentation

- Calculating unused leave, severance entitlements, and final pay

- Managing deregistration with tax and social security bodies

- Coordinating exit formalities and documentation delivery

This protects organisations from legal exposure and ensures that departures are managed transparently and professionally.

Strategic Benefits of Using a PEO in Mauritius

For companies operating or expanding into Mauritius, the PEO model provides multiple advantages that strengthen operational performance and reduce compliance risk.

Key Advantages

- Fast market entry without setting up a local entity

- Reduced compliance complexity in a highly regulated employment environment

- Reliable payroll management aligned with national tax and social security laws

- Support for expatriate talent through structured immigration processes

- Operational scalability for both short-term projects and long-term expansion

- Lower administrative burden on internal HR teams

- Enhanced workforce governance and documentation control

These advantages enable organisations to focus on core business operations while maintaining a compliant workforce structure.

Choosing the Right PEO Partner in Mauritius

Selecting a PEO provider with deep local expertise is essential for ensuring compliance and operational stability.

Evaluation Criteria

Organisations should assess partners based on:

- Expertise in Mauritian labour law and payroll regulations

- Comprehensive coverage across HR, payroll, compliance, and immigration

- Strong local presence and government relationships

- Transparent reporting and pricing structures

- Ability to support multinational or regional operations

- Consistency, reliability, and a proven compliance track record

The right partner becomes an integral extension of an organisation’s HR and compliance infrastructure.

Conclusion

Mauritius offers a highly attractive environment for business expansion, supported by strong governance, skilled talent, and efficient regulatory systems. However, employers must still navigate complex employment, payroll, and immigration requirements. Leveraging PEO Mauritius solutions enables organisations to hire efficiently, operate compliantly, and maintain strong HR governance across every stage of the employment lifecycle. In a market where accuracy, speed, and compliance are essential, the PEO model provides the structure and assurance needed for sustainable workforce expansion.